Why Investing in Indian Real Estate is a Smart Move

India’s real estate market has steadily evolved into one of the most attractive investment destinations globally. With a strong economic foundation, regulatory reforms, and growing urban demand, real estate in India offers long-term value and stability.

Here are several reasons why experts continue to recommend real estate investment in India:

- A Rapidly Growing Economy Drives Property Demand

India is among the fastest-growing major economies in the world. As urbanization accelerates and the middle class expands, the demand for quality residential and commercial spaces continues to rise, particularly in major metros and well-connected Tier-2 cities.

2. Real Estate is a Tangible Asset with Enduring Value

Property remains one of the few investment options backed by a physical asset. In India, where land is scarce and demand is consistent, real estate typically appreciates over time, offering both capital gains and utility.

3. Regulatory Reforms Have Enhanced Transparency

The introduction of the Real Estate (Regulation and Development) Act, or RERA, has brought much-needed accountability and structure to the sector. This has significantly increased investor confidence, with greater transparency, timely project delivery, and protection for homebuyers.

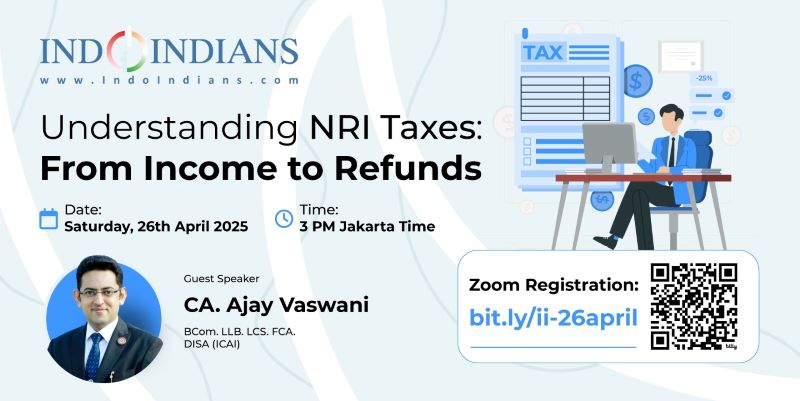

4. A Strategic Option for Non-Resident Indians (NRIs)

For NRIs, Indian real estate is a meaningful way to invest back home. With favorable exchange rates and attractive property prices compared to global cities, investing in India provides both emotional and financial returns. Improved property management services have also made remote ownership easier.

5. Increasing Rental Demand and Income Potential

With the return to office trends, demand for rental housing in key cities like Bengaluru, Pune, and Gurgaon is climbing. This has led to stronger rental yields, making real estate a viable source of passive income for investors.

6. Emerging Cities Provide Early-Mover Opportunities

Several Tier-2 cities are seeing a surge in development due to new infrastructure projects and corporate expansions. Cities like Kochi, Indore, and Bhubaneswar offer early investment potential with promising returns as they become future growth hubs.

7. Tax Benefits and Accessible Financing

Indian real estate offers several tax advantages, including deductions on home loan interest and principal repayment. Additionally, the availability of competitive home loans makes it easier for individuals to enter the market and build assets.

With its blend of economic momentum, regulatory strength, and increasing demand, the Indian real estate sector remains a powerful vehicle for long-term investment. Whether for personal use, rental income, or capital appreciation, property in India offers a compelling mix of growth, security, and tangible value.

Which city in India would you invest in? Do share in the comments below…