Opportunities at BOI IBU GIFT CITY for Retail, Corporate Customers

Indoindians successfully hosted a webinar with Bank of India on November 30th, 2024, to highlight the opportunities available at its International Financial Services Centre (IFSC) Banking Unit in GIFT City, Gujarat. Bank of India – IFSC Banking Unit (IBU) is an offshore banking unit which has been established to cater to the needs of both resident/NRI’s and foreign entities.

The session commenced with a warm welcome by Poonam Sagar, who introduced the esteemed speakers:

- Jayaprakash Bharathan, President Director, Bank of India Indonesia.

- Arvind Singh, Chief Executive Officer, Bank of India IFSC Banking Unit.

- Omkar Nath Upadhyay, Deputy Chief Executive Officer, Bank of India IFSC Banking Unit.

Jayaprakash Bharathan provided a brief overview of Bank of India Indonesia, highlighting its milestones, such as acquiring a small bank in 2007 and introducing services like internet banking, mobile banking, and same-day remittances. Arvind Singh then expressed gratitude to Poonam and participants for their support, sharing that the webinar was organized to address the growing interest in GIFT City’s banking opportunities, particularly among Indonesian stakeholders.

GIFT City: India’s Global Financial Hub

Arvind Singh detailed the significance of GIFT City, India’s first operational international financial services center. Envisioned by Prime Minister Narendra Modi, GIFT City aspires to be a global hub for financial and technology services. Its operations are regulated by the International Financial Services Centers Authority (IFSCA), which combines the regulatory powers of entities like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

He emphasized GIFT City’s role in green financing, supporting India’s net-zero emission goals, and serving as a gateway for global financial opportunities. Businesses in GIFT City benefit from incentives such as tax exemptions for up to 10 years and low operational costs, making it an attractive destination for foreign investments and collaborations.

Banking Services at BOI IFSC Gift City

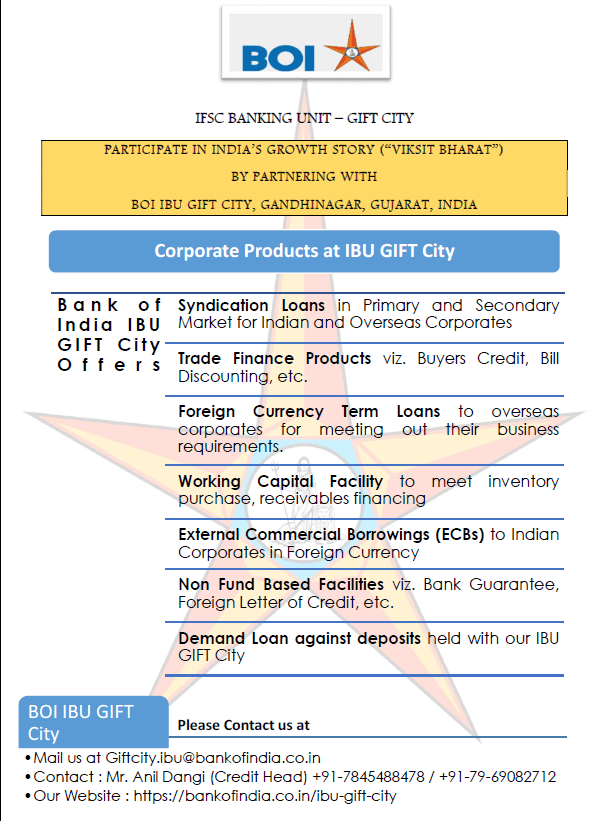

The Bank of India’s IFSC Banking Unit (IBU) offers a comprehensive range of international banking services tailored to both retail and corporate customers. Key services include:

- Corporate banking, external commercial borrowings, foreign currency term loans, and trade finance.

- Retail deposit products like savings accounts, current accounts, and term deposits with zero tax on deposits for NRIs and foreign passport holders.

- Treasury products and joint account facilities with nomination options.

The IBU also announced plans to introduce full-fledged internet banking services soon. For retail customers, features such as no account opening fees and no annual maintenance charges were highlighted, making GIFT City an efficient and tax-friendly option.

Collaboration and Accessibility

The speakers encouraged collaboration between Bank of India Indonesia and GIFT City for funding new and existing projects. Omkar Nath Upadhyaya discussed the ease of opening accounts without the need for physical visits, enabling a seamless banking experience for clients worldwide.

Arvind Singh and Jayaprakash addressed queries regarding regulatory requirements, reiterating that while GIFT City offers significant flexibility, adherence to local regulations is crucial for overseas projects.

More about Corporate Products at IBU GIFT City here >>

More about BOI IFSC BANKING UNIT – GIFT CITY here >>